Banner artwork by / Federico Gastaldi

Cheat Sheet

- Counsel’s expanded role. In-house legal teams guide workplace strategies and real estate cost reduction.

- Understand the market. Time lease negotiations and renewals appropriately; leveraging market conditions can yield beneficial outcomes.

- Efficient space utilization. Post-COVID workplaces need flexible, collaborative, and wellness areas.

- Value-adding brokers. Modern brokers offer comprehensive services, aiding critical real estate decisions.

In most organizations, the general counsel plays a crucial supporting role in shaping the company’s real estate strategy. That leadership typically goes beyond advising on legal and risk provisions. Many companies look to their general counsel for guidance on workplace strategy and office environments, market conditions, and overall cost reduction. Along with significant input from the chief financial officer (CFO), chief human resources officer (CHRO), and chief information officer (CIO), many perspectives need to be considered when executing an office real estate lease.

Depending on the company and its associated real estate portfolio, this can be once every 10 years or once a month. In our post-COVID environment, organizations of all sizes are grappling with the right balance of in-office versus remote work. While there is not a one-size-fits-all solution, all companies need to quantify a justifiable real estate solution that works for its most important asset — its people.

Seeing the bigger picture

It is important for general counsel to see the full picture relating to their organization’s real estate needs. This involves understanding the current market, locating suitable buildings, designing the right space, and partnering with real estate brokers and other experts to ensure the best possible outcomes.

An office renegotiation is a perfect opportunity for the chief legal officer to build relationships with other members of the C-suite. It is also a great chance to understand the business’s needs and real estate contractual terms. While the task may be daunting, the lessons learned and relationships gained will make the general counsel stronger in the next negotiation.

Recently, we’ve heard that it’s the “end” of the commercial office building. While there is certainly consternation in the evolving real estate markets, the end is not near. While development on the office side has slowed, new projects will come forth. Therefore, when the time comes to renegotiate an office lease, or if a company wants to understand its options, there are multiple factors to consider.

The market: What tenants need to know

The ideal time to begin monitoring the market is within 18 months of a lease expiration. Timing is everything, but the best timing depends more on a company’s goals than finding the low point in the overall market. Should your organization be further out from its expiration, landlords will still potentially entertain early renewal conversations, but the ability to leverage the current market conditions in your favor will be noticeably absent.

Every landlord is different. Some landlords are getting very competitive to retain tenancy and pursue new tenants by dramatically increasing concessions of free rent and tenant improvement allowances. In more than one instance, colleagues have been able to negotiate transactions that resulted in a negative return (net effective rate) to the landlord. This means, after a landlord has paid their tenant improvement allowances and any other fees including commissions, the return to the landlord is in the red. However, some landlords are taking more of a wait-and-see approach with the expectation that the market will not experience as much fluctuation.

The ideal time to begin monitoring the market is within 18 months of a lease expiration.

Understanding the undercurrents of the local real estate market is essential and ultimately ties all the transaction aspects together. While it may seem like the office market is saturated with sublease space, the frequent reality is that available sublease space is most likely in full floor increments, and most tenants do not need that much space. Additionally, due to the cost of construction associated with demising available floor space, it is rare that a sublandlord will want to spend the capital required to break the space for a smaller requirement. Regarding subleases specifically, keep in mind that the sublandlord has another full-time job and they are rarely interested in adding more to their “to do” list.

This market offers ripe opportunities for taking advantage of sublease space, but it can be like looking for a needle in a haystack to find a floorplan and aesthetic that can fit a company’s specific needs. Regardless of what’s happening in the market, construction is a big expense and taking advantage of existing conditions when finding the right fit is always a win.

Arm yourself with data

Before approaching a landlord, Savills, the real estate company of which two authors of this article work for, has found that the best outcomes result when companies arm themselves with data, starting with a deep dive into the specifics of their current lease, as well as how their employees work and interact with one another. Once that process is complete, companies should follow a path that includes “getting two bites at the apple.”

To get two bites of the apple, start the process early enough so you can get two peeks into the market. Once you have the data, you and your broker can then decide to act now or wait to restart the process after getting a preliminary benchmark. You should explore the market to see what opportunities exist that meet your goals; and when you are ready to transact, take a step back and decide whether it makes sense to pause or move forward.

The best outcomes result when companies arm themselves with data, starting with a deep dive into the specifics of their current lease, as well as how their employees work and interact with one another.

It is not enough simply to read the local business journal and look at general statistics on market rates and availability. To understand the true market dynamics, companies need to undergo a thorough research process. Engaging a seasoned commercial real estate broker is critical here. In doing so, a broker can assist in establishing a benchmark of what is possible right now, which will at the very least provide you with a benchmark for evaluating future opportunities. The process should include:

- Identifying current and projected business needs regarding how the workplace is used;

- Surveying employees on how they use the office and how often;

- Identifying specific relocation options; and

- Putting the current landlord through a competitive process.

And research alone is not enough. Get out to the real estate in person and walk through the space. Sometimes contractual terms, such as a contract with a vending machine company or professional cleaners are not apparent until seeing the space.

Even if your lease is not expiring in the next 18 months, there are still opportunities to evaluate your position with your current landlord. Considering an early renewal is an alternative. Assuming you occupy a significant portion of the floor, landlords will often be willing to discuss extending your lease in place. This can allow for the opportunity to “right-size” in the event your new scheduling plan allows you to shrink your footprint.

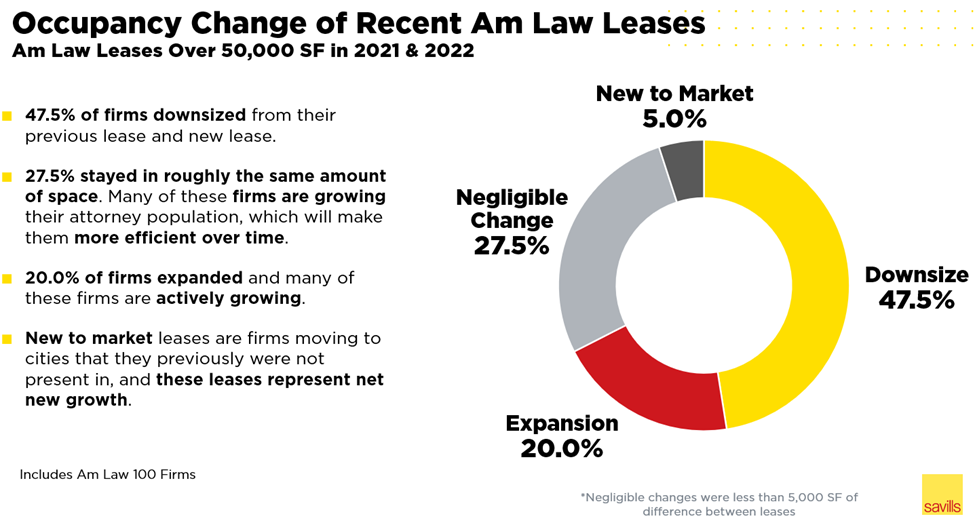

Tenants across all industries are still working to understand their post-COVID footprint. For example, during 2021 and 2022, 47.5 percent of law firms from the AmLaw 100 list decreased their footprint in their most recent lease transaction. Expansions accounted for only 20 percent of new transactions.

The shift in leasing dynamics

As landlords are being forced to restructure their maturing loans and potentially bring their buildings to market, increasing occupancy in the asset (on leases longer than three years) will allow the landlord to obtain increased value to the property, of which, a renewing tenant can look to potentially obtain additional concessions such as abated rent or an increased tenant improvement allowance. Savills has seen instances where landlords will agree to allow additional tenant improvement allowance to be used to offset rent as opposed to just improving the tenant’s space.

In the next wave of leasing, the market will experience a flight to capital as tenants relocate to buildings that are financially sound and not facing distress.

For well-capitalized tenants currently in the market for space, an additional level of scrutiny is being placed on landlords due to concerns around loan maturities and inability to fund promised tenant improvement allowances. Although it’s common for landlords to perform due diligence on prospective tenants, the tide is turning, and now tenants are doing their own research. In the next wave of leasing, the market will experience a flight to capital as tenants relocate to buildings that are financially sound and not facing distress.

From the tenant’s perspective, we have seen a flight to quality across the country. Tenants that have traditionally sat in a Class B building are moving into a Class A building for generally the same price. At the office buildings, employers can offer the in-building amenities — gyms, cafés, conference centers, golfing simulators, and manicured outdoor spaces — as incentives in addition to the fact that the space will come fully furnished.

Adapting to new work habits and demands

After COVID, the office is a different place. Prior to the pandemic, employees went to work Monday through Friday. However, with the pandemic forcing businesses to implement remote work strategies, the work from home flexibility has left an indelible mark ultimately leading to a decrease in the demand for office space for white collar jobs. Blue collar jobs have seen less of a decline on this front, but demand for comfortable spaces — particularly climate controlled — has increased.

Tenants should consider the following key trends:

- Increased demand for flexible workspaces: Co-working spaces and other flexible workspaces are becoming increasingly popular as businesses and employees seek more flexibility.

- A focus on collaboration and creativity: The office of the future will be designed to promote collaboration and creativity. This will involve creating spaces for informal meetings, brainstorming sessions, and teamwork.

- A focus on wellness and productivity: The office of the future will also be designed to promote wellness and productivity. This will involve creating spaces that are comfortable and well lit, as well as providing access to healthy food and fitness facilities.

By considering these topics and engaging a workplace professional, companies can make adjustments to their space that will ultimately quantify themselves directly to the bottom line. Some examples include companies:

- Only providing offices for employees who are in the office four days or more per week.

- Implementing a “hot desking” strategy.

- Turning offices into collaboration areas for teams to meet and share ideas and then be able to work from home on the heads down portion of their assignment.

Brokers as business advisors

Commercial real estate brokerage firms have evolved significantly over recent years. In the past, many brokers were thought of as just space-finders whose services would end after the one-off deal was complete. Today, in contrast, the top firms provide an umbrella of services and consultants who provide valuable and knowledgeable insight into multiple aspects of leasing space.

Firms such as Savills offer transaction management, incentive negotiations, labor analytics, workplace strategy, and lease administration, in addition to construction project management and real estate technology to manage your portfolio and building operating expense reconciliations. While every item on this menu of services might not be applicable to every transaction, having access to the data can be meaningful. Also, many firms focus on providing long-term advice relating to a company’s overall needs, rather than focusing on only the current transaction.

The best news is that, for the most part, a broker's service is typically free to tenants. While the tenant broker broker's fiduciary responsibility is to their client/the tenant, in the United States, the landlord is expected to pay the tenant broker's commission.

Brokers should be thought of as critical partners to in-house lawyers in educating them on the business and other non-legal issues relating to any real estate deal. By their nature, brokers are connectors, and typically one of the first stops when looking to set the real estate wheel in motion. Beyond that, brokers have knowledge of the issues that will be faced in any transaction and what is “market” in terms of key deal provisions.

The best news is that, for the most part, a broker’s service is typically free to tenants. While the tenant broker’s fiduciary responsibility is to their client/the tenant, in the United States, the landlord is expected to pay the tenant broker’s commission. The commission amount will range from a dollar amount per square foot per year to a percentage of the gross obligation of the lease.

When it’s time for renegotiating your office lease, consider the following checklist:

- Review current lease terms.

- Consult with CFO and CHRO.

- Assess market conditions.

- Identify all contractual obligations.

- Engage in early renewal conversations when possible.

- Walk the space to identify contractual terms, such as for vending machines, cleaning services, and other third-party arrangements that may not be obvious at first.

- Consult with a seasoned broker.

Keeping pace with the market

The evolving workplace and the ever-changing real estate market require that in-house counsel have the most up-to-date information available to them. Keeping a pulse on the market can inform you and your organization about when there might be a beneficial circumstance of which you may take advantage. Understanding the landlord’s position, and how your tenancy relates to the value of their asset, can be helpful as your firm develops viable alternatives. Ultimately, how efficiently you and your employees use the space can lead your team to the answers you seek when evaluating your office lease.