CHEAT SHEET

- Pain points. The law department should identify its challenges and pain points to determine which areas of the ACC Legal Operations Maturity Model it is targeting for improvement.

- Target improvements. The top three areas that law departments typically target for improvement are processes and technology, knowledge management, and legal department strategic planning.

- Strategic plan. Using the Maturity Model, the department can develop a strategic plan that outlines steps for achieving goals and desired outcomes. A one-year plan and a five-year plan are recommended.

- Technology roadmap. In conjunction with the strategic plan, law departments should consider creating a technology roadmap. However, not all challenges require a technology solution.

In recent years, law department leaders have given more attention to the operational aspects of running their departments and have realized that operational excellence is fundamental to the overall success of their department. This trend started with large corporate law departments, but the same strategic goals that drive large corporate law departments to focus on legal operations also apply to smaller law departments. After all, a common mission statement for law departments of all sizes is to deliver best-in-class legal services in a timely and cost-effective manner. Law department leaders are continually being asked to do more with fewer resources, which often means seeking to reduce expenses, implement efficiencies, and use data analytics and technology to drive value-enhancing legal advising.

In 2018, the Association of Corporate Counsel (ACC) Legal Operations division published a tool called the “Maturity Model for the Operations of a Legal Department,” which is designed to assist legal departments with assessing and benchmarking the maturity of their legal operations function. This article will explore how small and mid-size law departments can use the ACC Maturity Model to identify and selectively apply many of the same processes and technology solutions used by large corporate law departments to improve efficiencies and achieve large-scale savings and productivity enhancements.

ACC Legal Operations Maturity Model

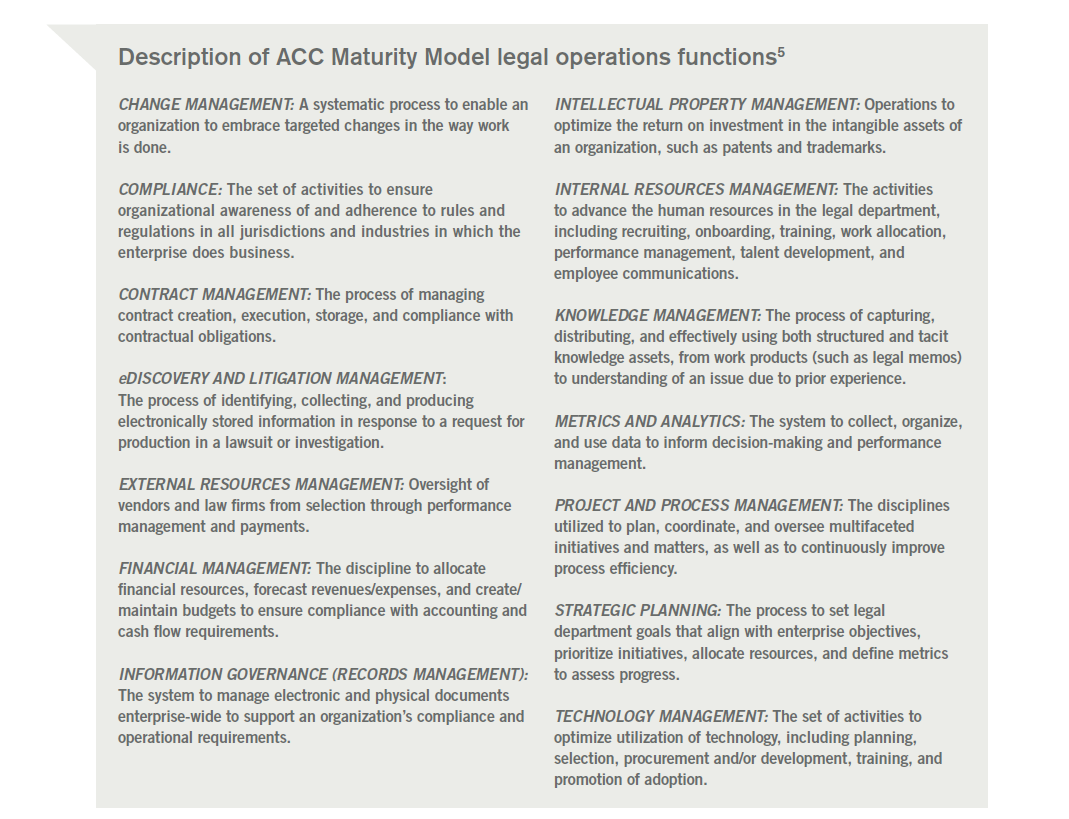

The ACC Legal Operations Maturity Model benchmarks three levels of maturity in 14 key operational function areas, including strategic planning, technology management, process management, financial management, vendor management, knowledge management, contract management, and information governance, among others. (See the sidebar for a brief description of each legal operations function benchmarked in the ACC Maturity Model.) For each legal operations function, the ACC Maturity Model categorizes different activities and processes into three levels of maturity: early stage, intermediate, and advanced.

In designing this tool, ACC recognized that the priorities and aspirational targets of a department will vary based upon the department’s size, staffing, and budgets. For example, a small or medium-sized legal department may aspire to achieve the “intermediate” level of maturity for many of the functions and the “advanced” level of maturity for only one or two key functions. In many cases, the resources, staffing, and budgets required to achieve the “advanced” level of maturity may be beyond the means of a small or medium-sized law department. This may also be true in even the largest organizations, which are unlikely to achieve the “advanced” level of maturity across all 14 functions.

A key benefit of this tool is that it can help law department leaders, regardless of the size of their department, set priorities for achieving the levels of maturity most relevant to their circumstances that will most improve the efficiency of their department. In announcing the tool’s launch, Reese Arrowsmith, then chair of ACC Legal Operations, and VP, head of legal operations at Campbell Soup Co., said the tool “sets forth markers of maturity in a variety of areas and identifies opportunities to innovate in the delivery and management of legal services without requiring each company to reinvent the wheel.”

Current state of legal operations in small and mid-size law departments

In 2019, Wolters Kluwer Legal & Regulatory and Priori conducted a survey of ACC members that analyzed the state of legal department efficiency, priorities, and pain points. The purpose of the survey was “to examine the trends in corporate legal operations, and in particular to investigate how small and mid-size legal departments: (1) have prioritized meeting operational challenges; (2) are adopting aspects of legal operations best practices; (3) are leveraging technology and alternative service providers; (4) view the challenges and successes of the above.”

The survey results were published in the white paper “The Evolving Role of Legal Operations for Small & Mid-Size Legal Departments.” A key finding was that “tellingly, only 54 percent of all survey respondents believe their legal department operates efficiently. This suggests that almost half of respondents believe there is substantial work to be done to improve the efficiency of their department.”

Strategic planning

Strategic planning is a key element of building a successful legal operations function. The first step for any law department is to identify its challenges and pain points in order to assess which areas need attention and can be improved. While every department will have its own unique set of challenges, pain points, and aspirational objectives, it is instructive that ACC members responding to the Wolters Kluwer/Priori study identified their top pain points (in order) as volume of work (91 percent ), contract management (86 percent), unstructured data (83 percent), and high outside counsel bills (78 percent). In addition to identifying pain points, the study asked respondents to indicate which areas identified in the ACC Maturity Model they were targeting for improvement in 2019. The study found that the top three areas departments are targeting for improvement were processes and technology (88 percent), knowledge management (78 percent), and legal department strategic planning (74 percent).

After a department identifies its challenges and pain points and assesses what operations and processes can be done more efficiently, it can then apply those insights to developing a strategic plan that lays out where the department is going and how it will get there (i.e., its strategies, goals, and desired outcomes). A detailed strategic plan for the legal department, which should be shared with the chief operating officer or business operations leadership and tie to the entire business’ strategic plan, helps ensure an alignment of financial, staffing, technology, and outside counsel decisions.

Many department leaders have found it helpful to create both a detailed one-year plan (which gets formally reviewed and updated at least annually) and a more aspirational five-year plan that provides a more fluid longer-term vision. In developing the initial strategic plan, law department leaders should look for easy wins to build confidence and internal support before tackling more challenging areas.

Technology management

In conjunction with developing a strategic plan, technology plays an increasingly important role in driving efficiencies and cost savings within legal operations, so it is critical to develop a technology roadmap that is focused on leveraging current technology and implementing new technologies that may be helpful in supporting the department’s legal operations.

In developing a technology roadmap, it is important to be mindful that not every challenge should be solved with a technology solution. Law department leaders should assess each process — step-by-step — in order to determine whether a technology solution could drive efficiencies. It is important to consider the return on investment (ROI) in considering any technology solution and only implement “need to have” rather than “nice to have” tools where there the savings or efficiencies can be quantified. At a foundational level, some of the typical systems include matter management, e-billing, contract management systems, and IP management.

As part of a technology management plan, law departments should regularly monitor and assess new technologies that could increase efficiencies, reduce costs, or allow the department to provide better legal advisory services. In many cases, tools that were originally developed for large law departments with a mature legal operations function (like workflow systems, contract management systems, and e-billing solutions) are being adapted to smaller operations.

A forward-thinking law department should also monitor the evolution and development of nascent technologies, such as artificial intelligence (AI), machine learning, and blockchain, which are likely to have profound implications for legal operations over the next decade.

Many department leaders have found it helpful to create both a detailed one-year plan (which gets formally reviewed and updated at least annually) and a more aspirational five-year plan that provides a more fluid longer-term vision.

External resources (vendor) management

Many small and mid-size law departments rely exclusively on traditional law firms for external legal work. As a result, these departments often end up paying traditional law firm billing rates even on low complexity matters. In addition, the process of reviewing invoices and enforcing compliance with billing guidelines is often manual and time-consuming. Further, without readily available synthesized spend data and trend visualizations, it is difficult for law department leaders to objectively assess the overall cost and value of work performed by each firm or effectively negotiate billing rates.

With high outside counsel bills being one of the top pain points for many legal departments, law department leaders may be able to achieve substantial cost savings and efficiencies by adopting processes from the intermediate or advanced level of maturity on the ACC Maturity Model in connection with the selection, engagement, and monitoring of external legal resources.

Selection of counsel

In connection with the selection of legal service providers, a smaller law department can implement a relatively simple data-driven process for finding the best (and most cost-effective) legal resource for each matter. The first step is to assess the risk and complexity of a matter to determine the best type of legal resources to engage.

For low-risk and low-complexity matters (and even phases of a matter), law departments should consider an alternative legal service provider (ALSP) as an substitute to traditional large law firm. In most cases, the ALSP can handle simpler matters in a more cost-efficient manner. For more complex issues, smaller law departments may seek to identify the most appropriate lawyer or law firm for the particular matter (taking into consideration expertise, level of experience, efficiency, and fees) by adopting processes similar to those used by large law departments, like maintaining a list of preferred “panel” firms and an internal database of lawyers and legal experts, as well as using internal survey feedback from prior engagements, including “win rates” (outcomes).

On larger matters or matters having a greater impact on the business (for example, significant litigation), smaller law departments should consider preparing a detailed request for proposal (RFP) that asks responding firms to describe their qualifications, experience, staffing, evaluation of the matter, budget/plan, and proposed fee arrangements. With the data from the RFP, the department can create a simple data-driven scorecard (essentially just a spreadsheet) that ascribes relative weight to factors the department thinks are critical in the selection of the outside counsel, such as substantive expertise, depth of practice, fees, relationship management, and diversity. A data-driven scorecard can generate a composite score for each RFP respondent and assist the law department in making more objective data-driven selections.

Although these tools are relatively simple to implement, they can generate outcomes that are identified as “advanced” in the ACC Maturity Model (“Sourcing decisions are ongoing considerations and LSPs are integrated in legal services delivery model; use of legal suppliers is driven by value provided at phase/task level”).

Engagement of counsel

In connection with the engagement of external legal counsel (or an ALSP), smaller law departments should consider developing a playbook of preferred and “fall back” terms for engagement letters and standard billing guidelines. In addition, where appropriate, volume and/or “early pay” discounts and alternative fee arrangements (AFAs) — either fixed fees, contingent fees, or hybrid structures — should be considered. These simple process improvements can be very effective tools for reducing external legal spend.

The ACC Maturity Model defines frequent consideration of AFAs to fall within “advanced” level of maturity in external resources management (“AFAs considered on all matters & heavily used”).

E-billing solution

The cornerstone of an “advanced” legal resource management process is an e-billing solution that facilitates the intake, review, and processing of legal invoices. E-billing systems significantly streamline the review process and can automatically adjust an invoice for any billing guideline violations.

The cornerstone of an “advanced” legal resource management process is an e-billing solution that facilitates the intake, review, and processing of legal invoices. E-billing systems significantly streamline the review process and can automatically adjust an invoice for any billing guideline violations. In addition, e-billing systems substantially reduce time to review and pay invoices, which creates opportunities to negotiate “rapid pay” discounts with external counsel. For small or mid-size departments that manage many different firms or matters, an e-billing solution often makes sense since the upfront investment to implement it is quickly repaid with material cost savings, increased efficiency, reduced administrative burden, and data to drive analytic tools to facilitate better management of external resources.

Operations dashboard

E-billing solutions capture a tremendous amount of data that can be fed into a data analytics platform that allows department leaders to quickly analyze every aspect of the service provided by their external legal service providers. Many of the e-billing systems have integrated data visualization and analytics tools, which means there is no incremental cost beyond the cost of the e-billing system.

These dashboards can be used to manage budgets and identify potential cost savings as well as track and benchmark many different key performance indicators (KPIs). The KPIs that a department tracks is variable but can include analytics on legal spend, use and success of AFAs, discounts, budgets, block billing frequency, staffing mix (i.e., the mix among different timekeeper levels), staffing concentration and efficiency (e.g., the number of timekeepers representing 80 percent of the hours, and the ratio of the number of different timekeepers to the total hours), diversity, and internal performance surveys. Dashboards can also provide insightful analytics to assist with counsel selection and identify potential AFA opportunities.

Budgeting

One of the best (and simplest) tools for managing outside counsel spend is to require the law firm or other legal service provider to establish an overall matter-level budget and, with respect to litigation and other complex matters, separate budgets for each stage of the matter. Once budgets are established, it is relatively easy to track legal spend against the budget and create alerts for when a matter is near or over budget. This allows department leaders to avoid any billing “surprises” and proactively address matters at risk for exceeding the budget before they become issues.

Relationship management

A critical component of external vendor management is establishing, maintaining, and promoting a department’s relationship with its law firms and other legal service providers. Law departments will benefit from treating law firms and ALSPs as value-producing business partners and continually seek to deepen the relationships to improve the level of service. In addition, where appropriate, law departments should look for opportunities to leverage the firms’ value-adds (e.g., training, secondments, summer associate projects) and value-enhancing capabilities, such as project managers and collaboration solutions.

Law department leaders should consider meeting with their law firms and legal service providers on a regular basis to describe any new strategic initiatives, to provide qualitative and quantitative feedback, and to identify any issues or areas where improvements could be made. In our experience, law firm partners want to improve and grow the relationship and appreciate the opportunity to candidly discuss their strengths as well any performance issues.

Financial management

Without an e-billing solution and data analytics platform, quarterly and annual budgeting is typically manual and often based upon the prior year’s total spend, which provides limited visibility to matter-level spend. By implementing a data analytics platform, law departments can track department and matter-level budgets in real-time and readily generate quarterly or annual forecasts based upon spending trends.

In addition, e-billing systems can require the law firms to submit budgets, accruals, and forecasts on a regular basis. These systems can significantly reduce the amount of time required by law departments to prepare financial reports and information for other stakeholders within the organization.

Contract management

ACC members responding to the Wolters Kluwer/Priori study identified contract management as one their top pain points (86 percent). For many small and mid-size departments, the contract review processes and contract administration are ad hoc and fragmented. In many cases, each department is responsible for managing their own contracts, and there is no central document repository. As a result, accessing contracts is often time consuming and, more importantly, monitoring compliance with key terms is often challenging.

ACC members responding to the Wolters Kluwer/Priori study identified contract management as one their top pain points (86 percent). For many small and mid-size departments, the contract review processes and

contract administration are ad hoc and fragmented.

A contract management system can create efficiencies, substantially reduce the amount of time spent by internal team members on administrative matters, and capture detailed data critical to an organization’s business.

A first step in developing a contract management solution is to assess the types of contracts that are used in the organization, the individuals or groups who need to access different contracts (as well as the frequency and extent of their access needs), and what key contract terms need to be monitored on a real-time basis. Although there are numerous robust contract management systems designed for large enterprises, a simple-to-use contract management system that is user-friendly and captures the contract’s key terms is appropriate for most small and midsize departments. In addition, many contract management systems have workflow processes that allow pre-approved contracts to be auto-generated directly from the contract request form completed by the end-user. With the ability to auto-generate contracts, these systems can, for example, allow sales teams to provide standardized contracts to customers without the need for any legal involvement.

In addition to considering a contract management system, law departments should consider developing a risk-calibrated contract review process. For material contracts, a department could create playbooks and clause “libraries,” which ensure standardization and drive efficiency in the review process. Also, for certain low-risk contracts (like NDAs), outsourcing the review of these contracts to an alternative legal service provider can substantially reduce the review cycle-time and free up internal resources for more value-enhancing activities.

Finally, to ensure compliance with an organization’s signature authorization policy, department leaders should consider requiring all contracts to be signed electronically using a secure e-signature solution provider. This process ensures that contracts are only signed by authorized signatories and provides an audit trail for compliance purposes as well as significantly reduces the administrative burden of executing hard copy documents with wet signatures. In fact, ACC members responding to the Wolters Kluwer/Priori study identified digital signature as the technology tool that had the most significant impact on the efficiency of their department’s operations (74 percent).

Knowledge management

ACC members responding to the Wolters Kluwer/Priori study identified knowledge management as one of the top three areas their department was targeting for improvement in 2019. A successful knowledge management process can drive efficiencies and significantly improve a law department’s ability to provide top-quality legal advice. Unfortunately, for many law departments, a significant amount of institutional knowledge relevant to their department had been accumulated over the years but there often was no formal process for accessing or managing these knowledge assets (KAs).

One of the biggest challenges to developing a successful knowledge management system is to get users to contribute and maintain the knowledge assets. As small or mid-size law departments consider implementing a knowledge management process, especially without the benefit of having dedicated personnel trained in knowledge management, they should explore using a simple, intuitive intranet (Wiki) as a repository for knowledge assets that are regularly used by the department. A simple internal Wiki is relatively easy to create and can be a cost-effective alternative to more robust (and resource intensive) platforms.

Metrics and analytics

In connection with implementing any process improvements, it is important to identify and track key performance indicators (KPIs) and other measures to assess progress against goals, quantify savings and efficiencies and to highlight areas for further improvement. Dashboards and data-driven reports are excellent tools for providing real-time information and indicators of performance across financial controls, outcomes, and operational matters. While once requiring heavy IT involvement, these tools can be utilized by smaller departments without requiring substantial involvement of corporate IT teams, thus making them accessible to even the smallest departments.

Other benchmarked legal operations functions

In developing the ACC Maturity Model, ACC recognized that the priorities and aspirational targets of a department will vary based upon the department’s size, staffing, and budgets. While each law department is different, a few of the legal operations functions benchmarked by the ACC Maturity Model are likely to be relevant to mostly larger law departments. In those circumstances, there may be no real benefit to expending resources to pursue more mature levels of operations. For example, if an organization is infrequently involved in litigation, the return on investment to develop sophisticated inhouse eDiscovery functionality does not justify expending resources in this area; rather it makes more sense to have outside counsel coordinate and provide eDiscovery and litigation support. Similarly, if an organization does not own a significant amount of intellectual property, monitoring and tracking trademarks are probably more appropriately handled via spreadsheets rather than by a fully integrated IP system.

In developing the ACC Maturity Model, ACC recognized that the priorities and aspirational targets of a department will vary based upon the department’s size, staffing, and budgets.

For certain organizations, even small or mid-size law departments need to operate at a higher maturity level for certain operational functions. For example, an organization that operates in a highly regulated industry is likely to need an advanced level of maturity in the areas of compliance and information governance (records management). In regulated industries, companies need to be able to be able to monitor and demonstrate compliance with their regulatory obligations. A robust compliance system can identify compliance risks with corresponding controls and procedures and document the results of compliance tests. Many regulators take the position that “if it isn’t documented, it didn’t happen.” A robust compliance system can help regulated companies avoid a determination of noncompliance resulting from their inability to prove compliance, rather than failure to meet those compliance obligations.

While less relevant for smaller departments with fewer team members, project and process management, internal resources management, and change management are important functions that should be considered in any assessment of a department’s legal operations maturity level.

A tool for efficiency

In sum, the ACC Maturity Model for Legal Department Operations is a great tool that small and medium-sized law departments can tailor to help their department become a more efficient cost center that adds value and drives more revenue to the bottom line.

ACC EXTRAS ON… Legal operations

ACC Docket

How Legal Ops Can Advance In-house Pro Bono (Jan. 2020).

Legal Ops Can Transform the Practice of Law, but Only if Everyone Embraces It (March 2019).