You want tighter integration between legal and the rest of the company. You want the budget to adopt new technologies. You want to be seen as someone who understands your company’s broader business operational levers. To make this happen, you need to learn to think and speak like a chief financial officer (CFO).

Total Cost of Ownership

The first lesson begins with three simple letters: TCO. This stands for Total Cost of Ownership. Chief financial officers and general managers look at activities and options based on their overall costs, applying TCO to understand the true cost of a proposed endeavor, rather than just the upfront price tag.

The key insight of TCO is that the true measurement of Cost requires a tabulation of all expenses, including paying for the wages, benefits, and overhead of employees and consultants needed to complete a task. Indeed, time costs money as well: waiting longer for payment makes the project more expensive and less valuable.

The computing world’s move to the cloud provides an example. How did the IT department convince the CFO and CEO to retire old systems and commit to paying every single year (forever) for entirely new software services?

The answer: TCO. IT leaders calculated the human and time cost of maintaining existing systems, including their employees’ salaries and benefits. The result shocked many: The total cost of maintaining existing systems was far higher than the software bill alone.

How did IT managers justify the inclusion of the cost of existing employees’ time in their TCO calculations? The managers applied the economic concept known as opportunity cost. While these employees’ salaries might already be in the budget, managers correctly noted that the employees’ time could be deployed elsewhere if they were freed from existing projects.

Thus, when making a TCO calculation, you should tally up the full cost (including benefits and perks) of your own team members who need to do work to use new systems because these employees could instead complete other tasks. And don’t forget that you are an employee as well — if you need to do work to complete an activity or use a particular software or service, you need to measure that time. Without measurement, you can’t compare options.

The concept of measuring the cost of your own employees’ time and including it when comparing methods of performing a task is now common in the corporate world. It is often described as Activity Based Costing (ABC). Companies now spend tens of millions of dollars per year hiring consultants and tasking internal staff to apply ABC by measuring the total cost of all staff who engage in a particular activity.

Applying ABC to legal tech tools

Legal tech providers differ widely in the scope of their offerings. Some provide tools that the user needs to deploy and configure for their particular application, while others provide an end-to-end service that requires little setup or training.

In order to measure the entire cost of these tools, you need to test the tools in a realistic setting and carefully measure the amount of employee time used. Include setup time, training time, customer support time, and maintenance time as part of your measurements because each minute an employee spends on those tasks is a minute she could be constructively deployed elsewhere. Also, include the time it takes your IT team and others to support the effort.

When calculating ABC, it is critical that you are measuring realistic scenarios for each product and process. For example, it’s difficult to obtain a realistic measurement of employee time required use an eDiscovery tool to cull through a wide variety of message types when the trial period is limited to processing only text messages.

Similarly, when using a software tool related to contracts, make sure you are applying it to the entire range of contracts your organization utilizes (including third-party agreements). You want to find tools and services that help your entire company, rather than just one department.

Tout the return on investment

If you want to budget for a new service or software for your legal department, measuring the cost and potential savings relative to other options on a TCO basis will earn you newfound respect from your CFO. Being a lawyer, you want more than just a persuasive argument — you want a winning argument.

To develop a winning argument to support budget allocations, measure the impact of your proposed expenditure beyond cost savings assessed through a TCO analysis.

How will it impact your entire company if you implement a particular tool or process? Some products and services might save employees in the legal department three hours per week but have a scant impact on any other department.

By contrast, a service that saves only one hour per week for the legal department but generates substantial revenue or efficiency gains for the entire company will yield a larger return on investment (ROI).

Your CFO is thinking about the welfare of your entire organization, not just the comfort or efficiency of the legal department. If you present your proposed expenditure in terms of ROI for the entire organization, you become a more strategic partner to the CFO and your requests are considered in light of the entire corporate budget, rather than a small amount typically allocated to the legal department.

Time to value

When lawyers hear the phrase “time equals money” we usually think about billable hours. When presenting an ROI analysis to your CFO, think about time differently. To put a value on time, assess the cost to your company for each day a particular process or service is not implemented.

For example, if a new contract analysis solution could help your company catch unwanted auto-renewals, then what is the cost to your company every month that you fail to implement the solution?

One key metric for assessing multiple services is to compare the time to value (TTV) of each one. A more expensive solution can provide a better ROI if it offers a much faster TTV.

Getting a benefit in two months adds far more value than getting the benefit in 12 months.

Adding AI

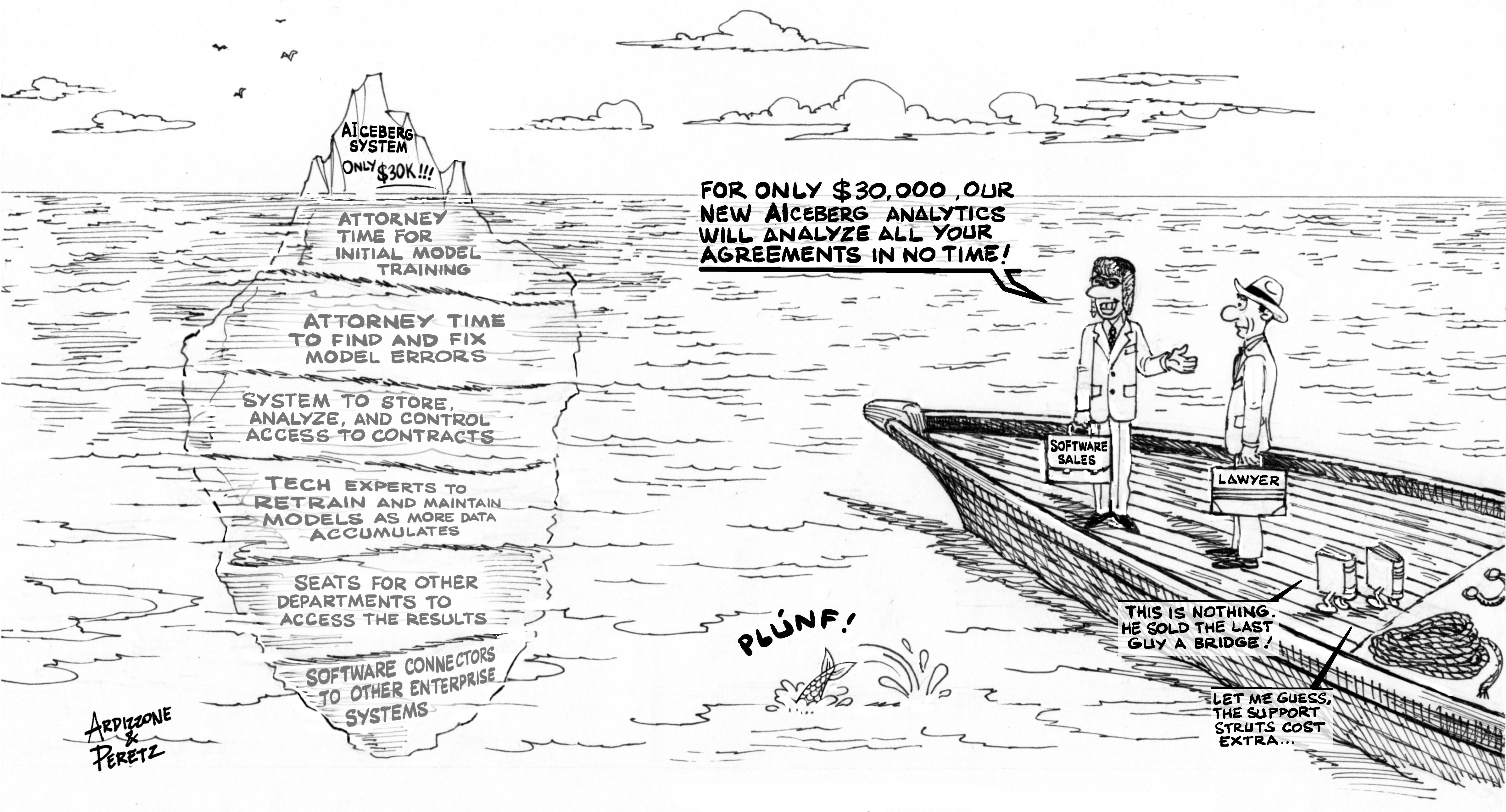

Scores of software vendors and services tout their artificial intelligence (sometimes referred to as machine learning or natural language processing) capabilities in the legal tech field. Applying TCO ensures you are not mislead by hype and false promises.

When applying AI to legal tasks and documents, one of the first vectors where solutions differ is the granularity of results. An AI system that points you to a potentially relevant page of a document is far less granular than a system that actually reads the relevant page and identifies the specific, accurate answer on the page.

A TCO analysis captures this important distinction. For a system that only brings you to the relevant page, rather than pulling out the specific answer, attorneys on your team need to engage in additional analysis for each and every document.

Measuring attorney time apply the tool to a wide variety of documents that your company regularly handles is essential to a TCO determination. Figure out the fully-loaded cost of those attorneys, including the cost of their benefits, office space, management, computers, and support staff. If your attorneys need to spend an extra five hours per month using a particular solution and the fully-loaded cost of such attorneys is US$100 per hour, add another US$500 per month to the TCO of the proposed solution.

Similarly, AI systems differ greatly in their recall and precision. When you need complete and accurate answers, an AI system that misses important details will have a substantially higher TCO when you tally the fully-loaded cost of attorney and paralegal time required to discover what the machines mixed. In AI-speak, the ability to find all possible instances of what you are seeking is known as recall.

Similarly, an AI system that has lots of false positives among its results will also have a much higher TCO once you take into account the cost of attorney and paralegal time to eliminate these false alarms, as well as the overhead cost to support, manage, train, and equip those legal professionals. In AI-speak, the ability of a system to eliminate false positives from your results is known as precision.

A TCO analysis cannot be conducted by merely listening to a vendor’s preferred recall and precision statistics. You do not know how the vendor’s system will work with your company’s particular documents and issues. You need to measure TCO yourself through a trial, using truly representative tasks and documents. Measuring TCO across multiple options will enable you to select the solution that’s also likely to be most agreeable to your CFO.

Some AI solutions may also take much more time to implement, perhaps due to the need for you to train and quality check models. This implementation and training time lengthens the TTTV of the solution. When you are seeking a budget allocation, show how you have compared the TTV of different options.

Don’t forget to measure the ROI of each AI solution across your entire company. AI can be applied to a range of problems, from suggesting document routing to ascertaining where — among your tens of thousands of contracts — payment terms are out of whack.

Document routing may shave 20 minutes a day from your paralegal’s time, whereas spotting payment terms issues may create major efficiency gains for finance and accounting. If other departments can benefit from a particular solution that helps legal as well, then you have a better ROI argument for prioritizing that solution first.

New thinking

Attorneys are often taught to be absolutist in their pursuit of objectives, regardless of time or expense. Perhaps this is due to the desire to provide zealous advocacy. Or perhaps, although few may admit it, it’s due to the desire to bill more hours.

In the in-house setting, absolutism is not possible. There is always too much work and not enough budget or staff. Applying a TCO, TTV, and overall corporate ROI framework will enable you to package your professional insight and expertise in a manner that your CFO will understand and respect.