CHEAT SHEET.

- Start simple. Clearly state your vision and engage with your vendors, IT staff, and users to ensure that new digital NDAs are executed properly.

- Set a protocol. If at any time, a provision of an automated contract is not met, all actions must stop and an attorney should become physically involved in the process.

- Enter the blockchain. A blockchain is most often defined as a public ledger for transactions that creates a unique string of encrypted characters to validate identities.

- Pick your partner. An organization looking to digitize contracts will have the best chance of success if it includes an organization that is currently using or is interested in using the technology.

In-house counsel are constantly under pressure to do more with less, while working with legal processes that don’t always allow for shortcuts. We juggle urgent deadlines, shifting priorities, and daily setbacks with little administrative support. Sometimes it seems that the only way to serve the opposing demands of business productivity and legal excellence is to spend more hours on the job.

But working longer hours isn’t a sustainable path. Instead, in-house counsel can look beyond the doors of the legal department and use technology to help streamline their work experience.

This, however, creates another challenge: How do we keep up with a rapidly evolving technological environment? The good news is you don’t have to be a technologist to automate your work experience — you just need to understand the concepts.

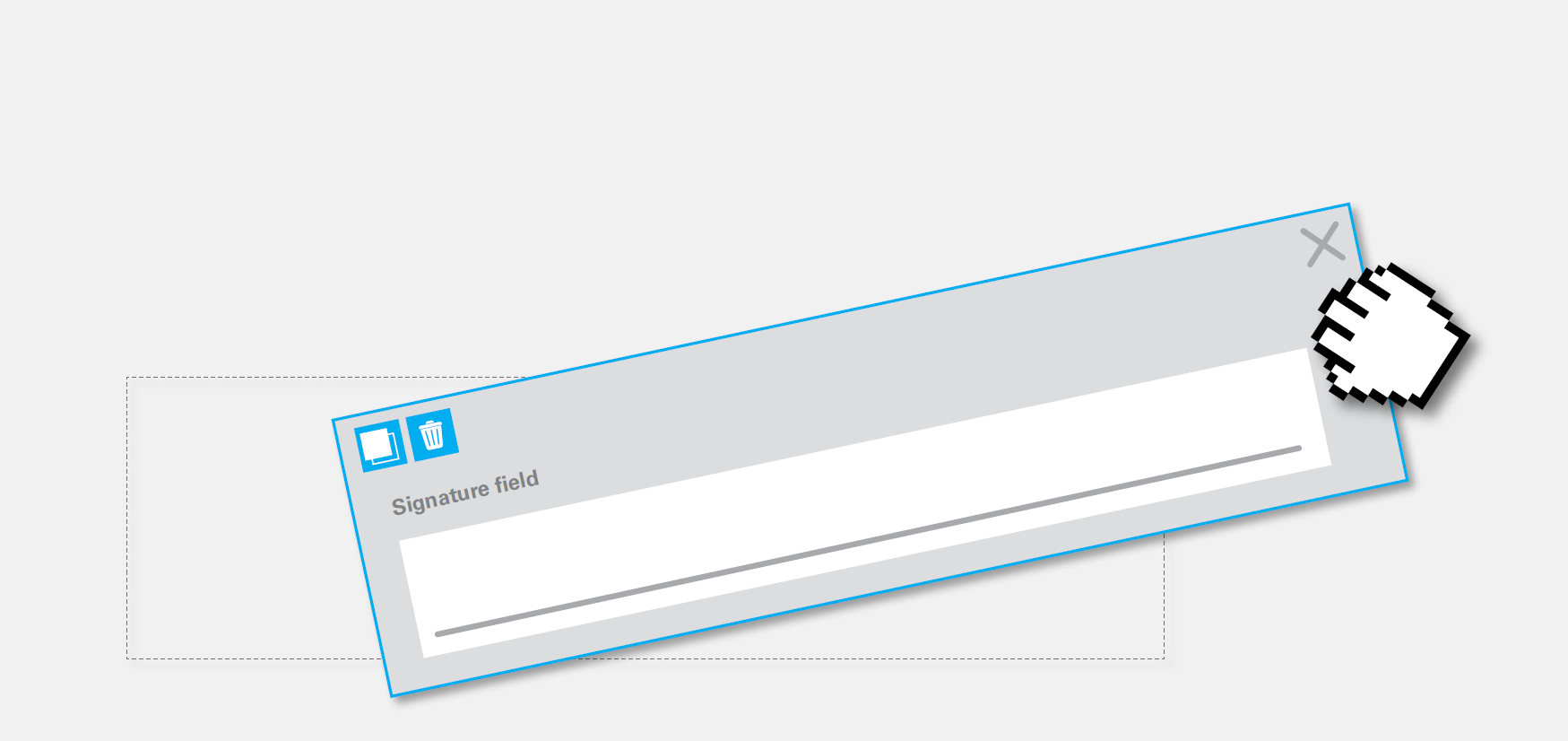

At Adobe, we transitioned from using traditional NDAs to using mutual NDAs that are pre-signed and executed electronically. Our plan was to create modular content accessed via a customization workflow that would allow various participants in the deal to grab pieces of the NDA that are relevant to their work. A visitor, partner, or vendor would only have to click on the signature field to electronically sign the NDA, via Adobe Sign, and then it would be archived. All this would occur without the legal department ever having to handle the agreement.

As in-house counsel, our attorneys did not have a lot of experience in leading technology efforts. We had one big advantage, however — as a software company, we had experienced people in-house that helped us reach our goal. While the project generally went smoothly, we did learn some important lessons to apply to our next project.

Start simple

Preparing simple agreements like NDAs and small vendor contracts eats up a lot of time for in-house counsel. Because these types of agreements are low risk and high volume, they’re a good place to start a streamlining initiative.

Assemble a development team

The transition from conventional to automated NDAs involved a lot of stakeholders. Our team included a project manager, who worked with vendors and attorneys, and attorneys, who worked with departments across the enterprise. Internal teams of web designers and testers also aided us.

The attorneys were on board right away. As the people responsible for processing over 1,000 NDAs annually, they were especially receptive to tools that would make their jobs easier. Working with the IT department also went smoothly. Adobe has an IT team dedicated to meeting the needs of its legal department, so our engineers were already familiar with legal vocabulary and compliance issues. If we’d lacked that technical resource, the experience would have been similar to our time working with a third party vendor — and that didn’t go so smoothly.

Lead your vendors to your vision

The third party content management system vendors had trouble understanding what we were trying to achieve. They had difficulty grasping the reasons behind our requests for certain functions, and were hesitant to push the technology as far as we wanted. At the same time, the legal department was new to the process of developing applications. We had to learn to ask for what we wanted in ways that made sense to the people who were actually building our tools. We had to teach lawyers to talk to engineers, and we had to teach engineers to talk to lawyers.

Remember, digital is different

We modeled the first version of the digital NDAs on our paper agreements, which were up to 12 pages long. We were still thinking in terms of a traditional approach, but to achieve real streamlining, we had to do more than simply replicate a paper process. We had to question everything, examine each section of the NDA template to see if it was necessary, and evaluate the risk of leaving it out. We also had to translate every section from legalese to plain English so users could easily scan the agreements and sign them with confidence.

Involve users early and often, and be prepared to revise

Users quickly let us know that the new tool was too long and complicated, so we cut out all questions that weren’t absolutely necessary. The user acceptance numbers rose, proving that the fewer the questions, the more likely people were to answer them all accurately.

The use of mutual, pre-signed, and automatically executed NDAs has improved efficiencies for both our company and partners significantly. As a result, we’re now looking for other ways to use technology to increase our efficiency.

Discussions about increasing the efficiency of a legal department usually raise questions about smart contracts. There’s still a lot of skepticism about this new type of contract. After all, many legal departments are still paper-based. However, as an innovative company, we stay focused on the next generation of technology. So an investigation of smart contracts is a worthwhile use of our time.

Contracts by code

A smart contract is generally a contract between parties recorded as a series of if/then statements. When a condition is met, an action is performed. The smart contract software will interact with other enterprise systems to conduct or enforce transactions without human involvement.

For instance, a smart contract may exist between trading partners Widget Corp and Giganto, Inc. The smart contract says that Widget Corp must deliver 1,000 widgets to Giganto by the first of the month in exchange for US$1,000. When Giganto receives the shipment and enters it into their inventory software, the smart contract triggers Giganto’s payment software to automatically release US$1,000 to Widget Corp.

The smart contract can be used for more complex transactions as well. Perhaps Giganto has a further agreement to sell those widgets to Micromart. Once the widgets are entered into its inventory software, Giganto’s smart contract triggers its invoicing system to send Micromart a bill. When that payment is received by Giganto’s accounting software, the order is automatically sent to the warehouse for shipping.

If at any time a condition is not met — for instance, if the widgets never arrive at Giganto — all actions stop, and Giganto never releases payment for the missing items. At that point, a human has to become involved.

Smart contracts won’t steal your job

Smart contracts are not perfect in every situation. Currently their use is limited to agreements that can happen automatically, like a simple exchange of goods for money. Some agreements that pass through an enterprise’s legal department fit this description, such as those with the coffee service vendors, office supply dealers, and IT manufacturers. These types of transactions can all be automated or “self-executed.”

Some aspects of contracts require litigation as a form of enforcement, such as indemnity clauses that protect a reseller from claims arising from a faulty product. Obviously, agreements like these cannot self-execute, so a smart contract cannot cover the entirety of such an agreement (although it may be used for pieces of it).

From cryptocurrency to commercial contracts

A contract is an agreement on terms between two parties — and while a smart contract can easily be used to describe those terms, how does an automated system prove exactly which parties agreed to them? Only recently has there been a technological way to answer that question: blockchain.

A blockchain is most often defined as a public ledger of bitcoin transactions. It is constantly growing as ‘completed’ blocks are added to it. The blocks are added in chronological order. Together, the chain of blocks contains a large amount of information, and can only be changed if all the preceding work is changed as well. In addition, the blockchain is shared across multiple computers, each of which can correct and update the same blocks. That makes tampering difficult, at best, because any computer that is hacked will be automatically corrected by the others.

Blockchain technology was originally developed as part of bitcoin transactions. The financial world quickly saw the potential for mainstream applications of blockchains, and tools based on the technology began to emerge. Now, blockchain adoption has spread beyond the financial arena and is being deployed by businesses that perform services as varied as tracking luxury goods and managing land titles.

However, a blockchain can store any kind of data — not just bitcoin transactions. One intriguing application for blockchain is as a form of digital signature. Each party can create a digital signature within blockchain. When a transaction is created, these digital signatures are combined into a unique string of encrypted characters that validates their identities. As such, smart contracts may support digital signatures for added assurance, as this form of digital signing doesn’t require a third party clearinghouse to handle the signature encryption and validation.

The attorney’s role in implementing smart contracts

When we developed our automated mutual NDAs, our legal department was heavily involved in the entire process. Launching a smart contract system is different. While the project will require a sponsor in the legal department to get things started, the real work is accomplished by the IT department.

The engineers can use one of several programming languages to write the code from scratch, or they can choose to install a platform, which is a collection of tools and services that simplify the implementation of a technology. Platforms are emerging rapidly. Today, according to AngelList, there are 315 startups offering some flavor of blockchains. The most established include Ethereum, SmartContract, and Eris Industries. Eris Industries is particularly interesting to legal professionals because it uses a markdown language, called Legal Markdown, that is specifically designed to handle legal citations, numbered lists, font changes, and other elements of legal agreements. As for the underlying block chains, they can be coded manually, purchased from a vendor and customized, or procured as blockchain-as-a-service.

Clearly, this phase of a smart contract project is outside the wheelhouse of the legal department, but there are plenty of activities for the legal team to handle before, during, and after the code is written.

Analyze. Is a smart contract pilot program worth your company’s time and money? The answer is yes if your company:

- Has trading partners who are also moving toward using smart contracts;

- Executes a lot of simple contracts with these partners;

- Operates on lean business principles; and,

- Positions itself as a technology leader.

If smart contracts seem like a possible fit for the enterprise, the next step is the same as for any project intended to streamline a legal process — identify the types of agreements that will present the least risk if they fail and the greatest benefit if they succeed. Once you’ve identified a good candidate for the project, the next question is whether the cost benefit of a successful implementation will be worth the investment in resources.

Network. Reach out to peers in the legal departments of trading partners to find out who else is considering or already developing smart contracts. After all, a company can’t use smart contracts unless it has partners willing to use them as well. The investment in developing a smart contract system only makes sense if a significant number of contracts are being executed between the organization and one or more of its partners. Otherwise, there will be no chance for return on investment. If there are a lot of business-critical systems involved in the transaction, the complexity will add to the cost.

Today, not many companies outside the financial and insurance sectors have deployed this technology. An enterprise that wants to move in this direction will have the best chance of success if its trading circle includes an organization that is already using smart contracts or is interested in using a pilot program. Large financial or insurance organizations are the types of businesses that are most likely to be interested and knowledgeable.

Today, not many companies outside of the financial and insurance sectors have deployed this technology. An enterprise that wants to move in this direction will have the best chance of success if its trading circle includes an organization that is already using or is interested in using a pilot program.

If a potential partner is identified, find out:

- Which technology platform they are using;

- How much of their solution is being developed in-house;

- Whether they are using a hybrid model or not, and what their reasoning is;

- How they gained buy-in from their own trading partners; and,

- Whether there is an opportunity to share resources, such as by lending in-house technology expertise or sharing research.

Lead. Your IT department is certainly aware of blockchain technology and your CEO is likely reading up about smart contracts, but it is ultimately up the legal department to decide whether to push the organization toward a pilot program. If a pilot program is launched, someone from the legal department will have to act as an information clearinghouse between the engineers, executives, and leaders in the legal department.

The software developers will have a methodology that they use to communicate with a project’s stakeholders, requiring frequent short meetings that the legal department’s liaison cannot miss. In these meetings, much of the discussion will consist of strings of acronyms with the occasional verb tossed in. Don’t hesitate to stop the torrent of techno-jargon and ask questions until the answers are clear.

Test and suggest. When the code is completed, your job is to try to break it. It’s better for it to break during an in-house test than in the middle of a live contract with a vendor. Don’t be alarmed if you find mistakes and glitches; no matter how thorough communication has been with the engineers, first versions are likely to reveal some glitches. Work with the engineers to prioritize fixes and jump back into the the software development lifecycle — meetings, production, and testing.

Lessons learned

Focus on the result. Don’t get hung up on how the paper process worked. Think about the end product and let your IT staff and vendors figure out better ways to get you there.

Write your requirements in plain English. Your vendors, IT staff, and users need to understand what you’re asking them do.

Ask for everything. Don’t limit your expectations, especially when you’re dealing with a vendor. You haven’t lost anything if they say no, but you can win big if they say yes.

Engage all along. Be clear that you want to see the work in progress. By asking to see the mockups, you can inspire your own creativity. It’s easier to make changes to drawings than edit a final product.

Remember that you’re a professional debater. Attorneys are trained to win arguments, but a streamlining project isn’t an argument. Listen and consider other viewpoints when stakeholders push back.

Uncertainties abound

Adopting a new technology always comes with a level of risk, which is even higher than usual for smart contracts. Programming isn’t law, and their legal validity is unclear at this time. It is currently uncertain as to whether a court would even consider a smart contract to be a true contract rather than just a mechanism of enforcement. Even if that answer were a broad yes, many other questions would remain.

- If a hybrid contract includes text as well as code, is the text a collateral contract?

- If an error in one party’s code has caused a breach of contract, how will that be determined and adjudicated?

- Does a smart contract represent terms or conditions?

- Smart contracts are supposed to be self-enforcing; if the technology is corrupted or hacked in transit between the two parties, who is responsible for making the wounded party whole?

These questions just scratch the surface of legal uncertainties surrounding smart contracts. However, as we’ve seen in recent years, technology is a juggernaut that may be slowed but rarely stopped by the legal system. These questions will be hammered out sooner than later, so attorneys working for enterprises that foresee a large potential benefit from the use of smart contracts should be prepared to offer guidance to their executives.

Are smart contracts smart business?

Although there are many potential benefits to using smart contracts, the business case for their adoption is hazy. Even companies eager to use them will probably end up relying on a hybrid version that uses natural language in the usual manner and smart contract code to automate enforcement. That approach would deliver the benefits of automation while still allowing for negotiation and providing assurance that the agreement would be litigable.

Another concern is that, while blockchains can be very secure if coded correctly, no software is invulnerable to hackers. Financial organizations are the most attractive targets, but any company moving large amounts of cash will also draw undesirable attention. That said, companies moving large amounts of cash or personally identifiable information are already attractive targets, whether they’re using smart contracts or not.

Finally, smart contracts are designed to be executed dozens, hundreds, or even thousands of times in an automated environment. That means that any flaw in the coding or natural language that creates risk has the potential to create a serious liability in a short period of time. So it becomes more important than ever for attorneys to ensure that contracts are bulletproof and buttoned-down.

Automation is here to stay

Just as the PDF transformed the way we transmitted and consumed information, automation represents the next frontier in how legal teams will capture contractual data and execute agreements. In-house counsel may not choose to blaze trails with smart contracts, but even the most traditional legal department would be wise to establish a methodology for evaluating emerging technologies, as smart contracts are the bellwether for the direction corporate law is heading.

While we are constantly evaluating new technologies, smart contracts don’t yet make sense for my company. The business case just isn’t there for us right now. We are not heavily involved with automated financial transactions, we don’t work with cryptocurrency, and we don’t have a volume for the types of transactions that would be improved by the use of self-executing agreements. Maybe our situation will change, or maybe blockchain technology will become more ingrained in the broader world of business. If either of those things happen, we’ll reconsider.

On the other hand, we continue to look for other ways to automate the work of our legal department and provide more streamlined services to our workforce and partners. Our NDA project resulted in better interactions with our customers and vendors while also easing the workload of our legal team. That’s a success we want to repeat.